Title Wachovia: Just what the Citigroup Needed published to feedsfullspeed.

Report sent to feedsfullspeed. about Wachovia: Just what the Citigroup Needed

This article is located at feedsfullspeed.

The basis for the crisis is problems in mortgage-backed securities, which saw their value plunge as home prices have gone into their worst slide since the Great Depression and foreclosures soared to record levels. In turn, the market for trillion of dollars worth of those securities held by major firms evaporated, sending them down to fire sale prices and raising the risk of widespread failures among the nation's major financial firms.

Under the plan, Treasury will buy the mortgage backed securities, either directly from the firms or through an auction process. It may also arrange to provide guarantees for the securities up to their original values in return for premiums they would charge current holders of the securities.

Under the plan, Treasury will buy the mortgage backed securities, either directly from the firms or through an auction process. It may also arrange to provide guarantees for the securities up to their original values in return for premiums they would charge current holders of the securities.

To make the legislation more politically palatable, the bill calls for the government, as an owner of a large number of mortgage securities, to exert influence on loan servicers to modify more troubled loans to help prevent additional foreclosures. It also provides that the government will take equity in the firms that sell the securities to the government, and limits pay packages for top executives.

To make the legislation more politically palatable, the bill calls for the government, as an owner of a large number of mortgage securities, to exert influence on loan servicers to modify more troubled loans to help prevent additional foreclosures. It also provides that the government will take equity in the firms that sell the securities to the government, and limits pay packages for top executives.

The legislation comes amid great upheaval in the nation's financial system. On Monday morning, the Federal Deposit Insurance Corp., which insures deposits at failed banks, arranged for the sale of the banking assets of Wachovia (WB, Fortune 500), the nation's No. 4 bank holding company, to Citigroup (C, Fortune 500) for $2.2 billion in stock.

The legislation comes amid great upheaval in the nation's financial system. On Monday morning, the Federal Deposit Insurance Corp., which insures deposits at failed banks, arranged for the sale of the banking assets of Wachovia (WB, Fortune 500), the nation's No. 4 bank holding company, to Citigroup (C, Fortune 500) for $2.2 billion in stock.

That follows three weeks of other shocks: the Treasury Department's seizure of mortgage finance firms Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500); Wall Street firm Lehman Brothers' bankruptcy filing; rival Merrill Lynch (MER, Fortune 500) purchase by Bank of America (BAC, Fortune 500).

That follows three weeks of other shocks: the Treasury Department's seizure of mortgage finance firms Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500); Wall Street firm Lehman Brothers' bankruptcy filing; rival Merrill Lynch (MER, Fortune 500) purchase by Bank of America (BAC, Fortune 500).

In addition, the Fed bailed out insurance giant American International Group (AIG, Fortune 500), loaning it $85 billion in return for a nearly 80% stake. while Washington Mutual (WM, Fortune 500), the nation's largest savings and loan, became the largest bank failure in history.

In addition, the Fed bailed out insurance giant American International Group (AIG, Fortune 500), loaning it $85 billion in return for a nearly 80% stake. while Washington Mutual (WM, Fortune 500), the nation's largest savings and loan, became the largest bank failure in history.  Citigroup to Acquire Wachovia Assets

Citigroup Inc. agreed to acquire Wachovia Corp.'s banking operations on Monday for $2.1 billion in stock and will assume another $53 billion in Wachovia debt.

Citi to acquire Wachovia's banking operations MarketWatch

Citigroup buys Wachovia bank biz for $2.2B CNNMoney.com

Indian Rupee Falls to 2-Year Low as Funds, Importers Buy Dollar

By Anoop Agrawal Sept. 29 (Bloomberg) -- India's rupee slumped to a two-year low as stock declines spurred fund outflows and a $700 billion US bank rescue plan helped bolster the dollar.

Central banks inject more cash as bank crisis deepens Reuters

EU vows to quickly assess state bailouts of banks Forbes

Freddie, Fannie subpoenaed; SEC opens probes

MarketWatch - 41 minutes ago

By John Spence, MarketWatch BOSTON (MarketWatch) -- Mortgage giants Freddie Mac and Fannie Mae, both taken over by the government in the wake of the subprime mess, said Monday they have been subpoenaed by federal prosecutors.

Fannie, Freddie get federal grand jury subpoenas Reuters

US authorities investigating Fannie and Freddie International Herald Tribune

Morgan Stanley Completes Mitsubishi Deal

New York Times - 48 minutes ago

By LOUISE STORY Morgan Stanley announced Monday that it had completed a previously announced deal to raise capital from Mitsubishi UFJ Financial Group, a large commercial bank in Japan.

Morgan Stanley Gets $9 Billion From Mitsubishi UFJ (Update2) Bloomberg

UPDATE: Mitsubishi UFJ To Pay $9 Billion For 21% Of Morgan Stanley CNNMoney.com

Paulson Must Make $700 Billion Rescue for Banks Work (Update2)

By Scott Lanman and Christopher Stern Sept. 29 (Bloomberg) -- Treasury Secretary Henry Paulson and congressional Democrats hammered out a consensus on spending up to $700 billion to rescue the financial industry.

Shape of Massive Bailout Bill Starts to Develop Definition Wall Street Journal

Treasury Would Emerge With Vast New Power New York Times

Shareholders of Belgian InBev voted Monday to approve the $52 billion takeover of Anheuser-Busch, paving the way to create the world’s largest brewer.

On Monday, it was reported that banking operations at Wachovia (nyse: WB - news - people ) would be heading over to Citigroup (nyse: C - news - people ). Citigroup will assume the company's senior and subordinated debt, in a huge relief to the ...

Wachovia sinks as investors weigh its fate CNNMoney.com

Wells and Wachovia said to be in advanced talks Bizjournals.com

TheStreet.com - guardian.co.uk - MarketWatch - Zacks.com

all 652 news articles » WB - WFC - C

Citigroup to Acquire Wachovia Assets

Citigroup Inc. agreed to acquire Wachovia Corp.'s banking operations on Monday for $2.1 billion in stock and will assume another $53 billion in Wachovia debt.

Citi to acquire Wachovia's banking operations MarketWatch

Citigroup buys Wachovia bank biz for $2.2B CNNMoney.com

Indian Rupee Falls to 2-Year Low as Funds, Importers Buy Dollar

By Anoop Agrawal Sept. 29 (Bloomberg) -- India's rupee slumped to a two-year low as stock declines spurred fund outflows and a $700 billion US bank rescue plan helped bolster the dollar.

Central banks inject more cash as bank crisis deepens Reuters

EU vows to quickly assess state bailouts of banks Forbes

Freddie, Fannie subpoenaed; SEC opens probes

MarketWatch - 41 minutes ago

By John Spence, MarketWatch BOSTON (MarketWatch) -- Mortgage giants Freddie Mac and Fannie Mae, both taken over by the government in the wake of the subprime mess, said Monday they have been subpoenaed by federal prosecutors.

Fannie, Freddie get federal grand jury subpoenas Reuters

US authorities investigating Fannie and Freddie International Herald Tribune

Morgan Stanley Completes Mitsubishi Deal

New York Times - 48 minutes ago

By LOUISE STORY Morgan Stanley announced Monday that it had completed a previously announced deal to raise capital from Mitsubishi UFJ Financial Group, a large commercial bank in Japan.

Morgan Stanley Gets $9 Billion From Mitsubishi UFJ (Update2) Bloomberg

UPDATE: Mitsubishi UFJ To Pay $9 Billion For 21% Of Morgan Stanley CNNMoney.com

Paulson Must Make $700 Billion Rescue for Banks Work (Update2)

By Scott Lanman and Christopher Stern Sept. 29 (Bloomberg) -- Treasury Secretary Henry Paulson and congressional Democrats hammered out a consensus on spending up to $700 billion to rescue the financial industry.

Shape of Massive Bailout Bill Starts to Develop Definition Wall Street Journal

Treasury Would Emerge With Vast New Power New York Times

Shareholders of Belgian InBev voted Monday to approve the $52 billion takeover of Anheuser-Busch, paving the way to create the world’s largest brewer.

On Monday, it was reported that banking operations at Wachovia (nyse: WB - news - people ) would be heading over to Citigroup (nyse: C - news - people ). Citigroup will assume the company's senior and subordinated debt, in a huge relief to the ...

Wachovia sinks as investors weigh its fate CNNMoney.com

Wells and Wachovia said to be in advanced talks Bizjournals.com

TheStreet.com - guardian.co.uk - MarketWatch - Zacks.com

all 652 news articles » WB - WFC - Ccategories - The Money Times

... tenders resignation; Automaker loans to be part of bailout; Court ... World faces possible food crisis; Longs turns down Walgreen ... polar research; Google and T-Mobile set to challenge Apple; The ...

more ...

go to website

Cached

Forex Blog: Investing & Trading

... yielding currencies- grows, the Yen (because of low ... A government bailout will certainly stabilize Freddie and ... These new ETFs will expand this list to include the Indian Rupee ...

more ...

go to website

Cached

domain-b.com : Indian business : economy : economy - general : index

Wall Street disappointed, US markets down 12 December ... Inflation rates falls to a 5-year low at 2.97 per cent ... Dollar fall gives Indian companies a Rs6,500 crore ...

more ...

go to website

Cached

Asia-Pacific Business News - - Week ending May 10, 2008: China ...

... India's inflation, running at a 3 1/2 year high is ... Rupee Slides to 13-Month Low as Crude Oil at Record Boosts Dollar Demand ... Rupee Falls as Crude Oil Trading Near Record $122 Spur ...

more ...

go to website

Cached

Fund my Mutual Fund: 2007-10-21

Entering this week I had a relatively low short ETF ... Going into Apple's call on Monday night which one knew ... India Up, China Down? Changing my Indian Focus

more ...

go to website

Cached

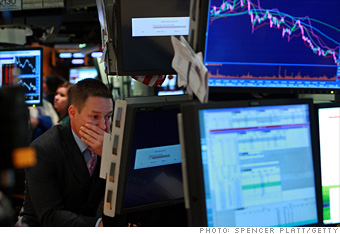

he news comes as President Bush and other congressional leaders looked to shore up support for the rescue measure, which they and many on Wall Street believe is a difficult but necessary choice to revive moribund credit markets. Banks and other financial houses are hesitant to lend to one another because of fears about bad mortgage debt on companies' books. Tight lending conditions make it harder and more expensive for businesses and consumers to get a loan, which can hurt the economy. While congressional leaders said they had the headcount to pass the vote — a Senate vote could come as early as Wednesday — investors were likely to remain unnerved until the votes are complete. Investors also digested news that consumer spending in August fell to its lowest level in six months. The Commerce Department said consumer spending remained unchanged in August, rather than increasing 0.2 percent as economists had expected and the worst showing since February. Personal incomes rose a better-than-expected 0.5 percent after falling 0.6 percent drop in July. But after-tax incomes fell by 0.9 percent. Incomes benefited in past months from the government's stimulus checks. Dow Jones industrial average futures fell 169, or 1.52 percent, to 10,978. Standard & Poor's 500 index futures fell 19.80, or 1.63 percent, to 1,194.70, and Nasdaq 100 index futures fell 30.00, or 1.79 percent, to 1,644.75. Credit markets remained strained Monday. The yield on the 3-month Treasury bill, considered the safest short-term investment, fell to 0.66 percent from 0.87 percent late Friday. The yield on the T-bill falls as demand grows; investors are at times willing to take the slimmest returns to safeguard their principal. The yield on the benchmark 10-year Treasury note fell to 3.78 percent from 3.84 percent late Thursday. The dollar was mixed against other major currencies, while gold prices rose. Light, sweet crude fell $5.19 to $101.70 in premarket electronic trading on the New York Mercantile Exchange. To tamp down criticism of the plan, Congress can restrict how much of the money goes out the door at once. It also includes limits on pay packages of top executives as well as assurances that the government also would ultimately be reimbursed by the companies for any losses. The Treasury would be permitted to spend $250 billion to buy banks' risky assets, giving them a much-needed necessary cash infusion. There also would be another $100 billion for use at president's discretion and a final $350 billion if Congress signs off on it. Investors are also worried about overall sluggishness in the world's economy. In the U.S., for example, unemployment now sits at a five-year high of 6.1 percent. That rate is expected to increase, perhaps putting further pressure on consumer spending, which accounts for more than two-thirds of the nation's economic activity. For the Wachovia deal, Citigroup's acquisition will include five depository institutions and assume debt. The FDIC said Citigroup will absorb up to $42 billion of losses on a $312 billion pool of loans. The FDIC said it would cover any additional losses. The FDIC gets $12 billion in preferred stock and warrants under the deal. Citi shares fell 5.2 percent in premarket electronic trading. Investors overseas were nervous ahead of the votes in Washington and after three European governments agreed to inject Fortis NV with a $16.4 billion bailout. Fortis, with has headquarters in Brussels, Belgium and Utrecht, Netherlands, is Belgium's largest retail bank. The British government said it is nationalizing mortgage lender Bradford & Bingley, which has a $91 billion mortgage and loan portfolio. It was the latest sign that the credit crisis has spread beyond the U.S. Japan's Nikkei stock average fell 1.26 percent. Britain's FTSE 100 declined 3.23 percent, Germany's DAX index fell 2.75 percent, and France's CAC-40 fell 2.58 percent

Videos from YouTube

Title: Let's Play "WALLSTREET BAILOUT" The Rules Are... Rep Kaptur

Categories: military,economy,congress,taxcuts,gitmo,habeas,News,congresswoman,relief,mama,bush,kaptur,iraq,cheney,bill,corpus,

Published on: 9/22/2008 8:03:52 PM

Title: Palin: Bailout is about healthcare!

Categories: News,bailout,couric,news,cbs,thinkprogres,healthcare,palin,

Published on: 9/25/2008 11:25:46 AM

Title: Congressman Ron Paul Schools Bernanke on the Bailout Plan

Categories: Price,Monetary,Wall,Bail,Constitutionality,News,Bailout,Ron,Bernanke,Street,Out,Authority,Debt,Fixing,Federal,Paul,Depression,

Published on: 9/24/2008 11:32:51 AM

Title: Ron Paul Fox News 9/17/08 AIG bailout

Categories: News,Fox,Baldwin,Ron,McKinney,News,Paul,Nader,

Published on: 9/17/2008 3:23:30 PM

Title: This Is How The Bail Out Will Screw You

Categories: bad,paulson,pay,off,economy,bailou,the,henry,News,loans,money,street,john,bush,financial,treasury,loan,turks,crisis,wall,republicans,mccain,young,hank,administration,secrretary,

Published on: 9/22/2008 9:44:53 PM

No comments:

Post a Comment